13%

Value-added tax (VAT) rates

--%

VAT refund rate

SECTION

SECTION 16: MACHINERY AND MECHANICAL APPLIANCES; ELECTRICAL EQUIPMENT; PARTS THEREOF; SOUND RECORDERS AND REPRODUCERS, TELEVISION IMAGE AND SOUND RECORDERS AND REPRODUCERS, AND PARTS AND ACCESSORIES OF SUCH ARTICLESChapter

Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereofHeading

Heading 8414: Air or vacuum pumpsTax rebate rate

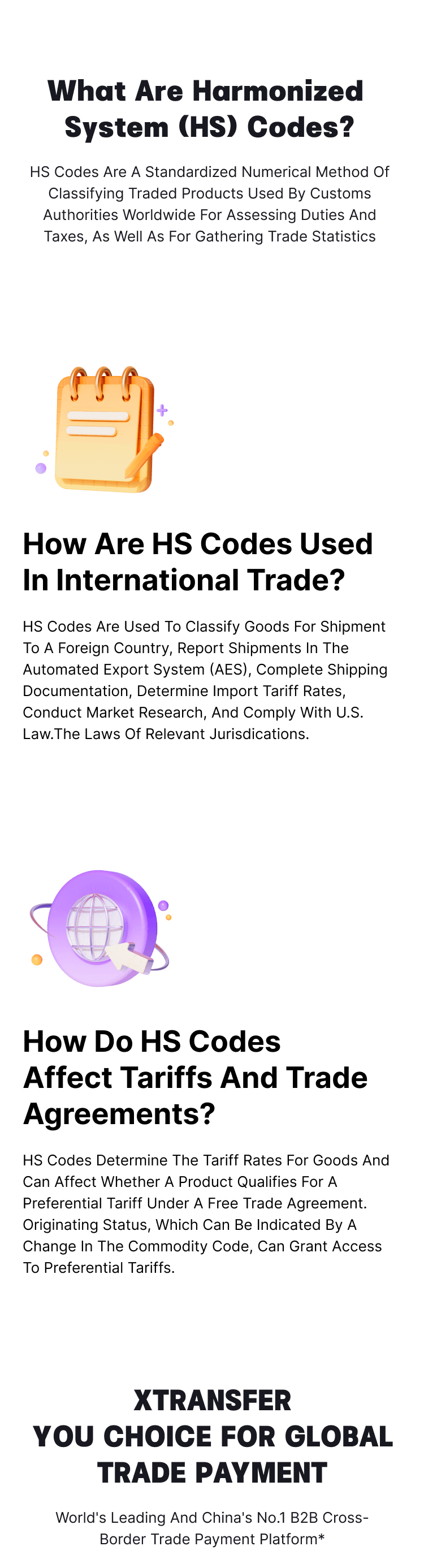

Secure and stable

Lightning fast send and receive

Save money, effortlessly

Goodbye to hustle and bustle

Hear what our customers say

"I use XTransfer not only to pay my Chinese suppliers, but also to pay and get paid globally. This account alone solves all my needs."

"As both an importer and exporter, I've found XTransfer to be invaluable in streamlining my payment processes. It has truly simplified international transactions for my business!"

"Cash flow has always been a big issue in export. It is secure and compliant to pay suppliers in mainland China through XTransfer, and the money arrives in no time."

"XTransfer is safe and compliant. Money arrives in seconds 24/7, which has sped up my trade process. Buyers are more willing to work with me because of that!"

"XTransfer is not merely an online platform. Its knowledgeable staff are highly supportive in facilitating legitimate money transfer, effectively minimizing the risk of account freezes to zero."

"With 20 years in the biometric industry and a global customer base, we've used XTransfer for three years - a fast and convenient solution for payment collection."